U.S. dairy market update with Ever.Ag

Tuesday, November 1, 2022

(0 Comments)

By Matt Tranel, Ever.Ag contributor Cheese prices are enjoying their second-strongest year on record. CME spot blocks have averaged $2.07 per pound year to date, and cash-settled futures are topping $2.00 for every contract month in 2023. But uncertainty remains amid a cloudy macroeconomic climate. Cheese exports held strong through August, with net shipments at a record 408 million pounds. Strong volumes should continue through the end of the year and into 2023, as US holds a modest price advantage to competitors in Europe and Oceania. However, declining prices in New Zealand and a strong US dollar are providing some headwinds.

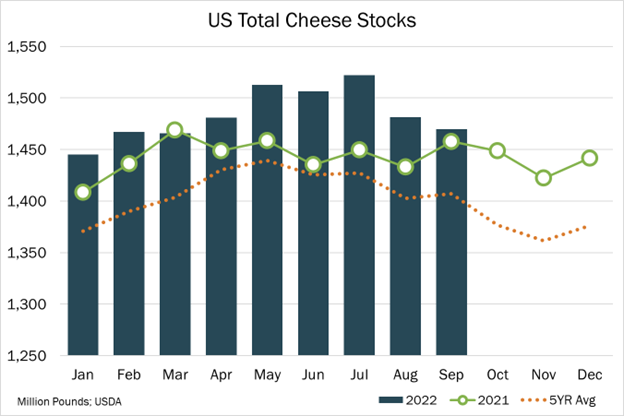

Domestic cheese consumption remains healthy, rising 1% year-over-year during the first eight months of 2022. Retail sales, however, are trailing prior-year levels amid persistent inflation. Natural cheese prices reached $5.80 per pound in August, an all-time high.  Meanwhile, Cold Storage data shows abundant supplies, with inventories reaching a record high of 1.47 billion pounds in September. But that was only up 0.8% year-over-year, the smallest margin in a while. Still, capacity set to come online in the years ahead should keep the market well supplied. Meanwhile, Cold Storage data shows abundant supplies, with inventories reaching a record high of 1.47 billion pounds in September. But that was only up 0.8% year-over-year, the smallest margin in a while. Still, capacity set to come online in the years ahead should keep the market well supplied.

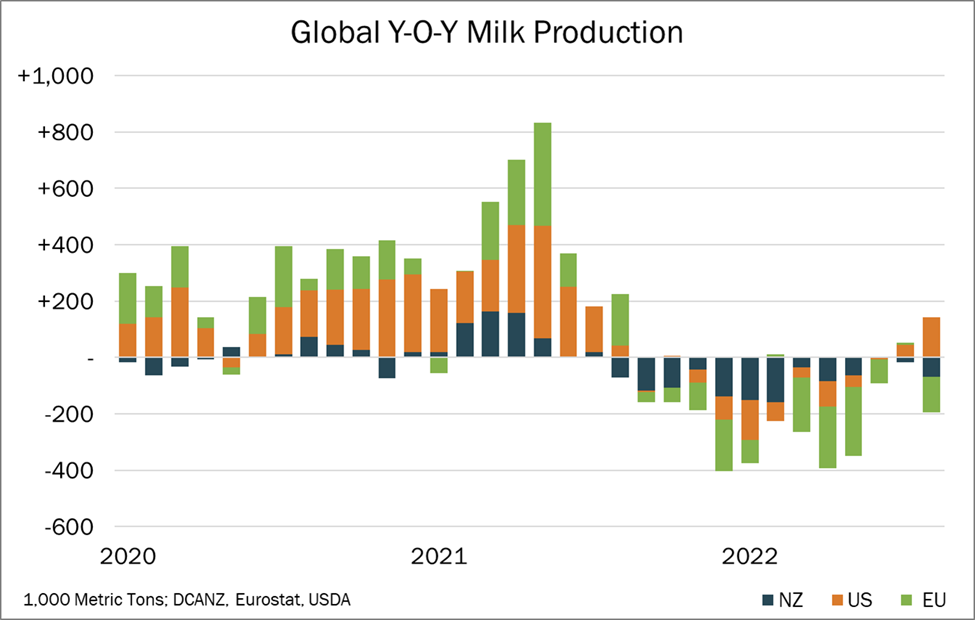

Milk production prospects remain a big wild card. Base/excess programs, along with elevated feed costs, weighed on the US herd early in the year, sending cow numbers as low as 9.37 million head in January. But herds have since expanded, reaching 9.41 million head in September. Output is also rebounding, rising 1.5% year-over-year last month. Reports suggest growth is likely to continue, though base/excess programs will ensure production stays in check. Production struggles continue in Europe, where drought, high feed costs and regulatory pressures are constricting milk flows. While output is showing some improvement, challenges remain as government regulations require farmers to adjust agricultural practices. Unfavorable conditions are also weighing on production in New Zealand, with much of the 2021-2022 milk season spent in negative territory. The 2022-2023 production season isn’t looking much better, as wet weather is reportedly dragging down volume as much as 5% below last year’s levels.

Given a mixed supply and demand picture, macroeconomic pressures are adding additional uncertainty around cheese use. The US Consumer Price Index rose 8.2% year-over-year in September, even as the Federal Reserve raised interest rates for the third time this year. Americans are also facing an expensive winter season amid elevated energy prices, with heating oil futures hovering at record highs for this time of the year and natural gas prices nearly double last year’s levels. At the same time, European consumers are grappling with household energy costs due to a slowdown of the Nord Stream pipeline. Given a mixed supply and demand picture, macroeconomic pressures are adding additional uncertainty around cheese use. The US Consumer Price Index rose 8.2% year-over-year in September, even as the Federal Reserve raised interest rates for the third time this year. Americans are also facing an expensive winter season amid elevated energy prices, with heating oil futures hovering at record highs for this time of the year and natural gas prices nearly double last year’s levels. At the same time, European consumers are grappling with household energy costs due to a slowdown of the Nord Stream pipeline. Major relief isn’t likely in the near term. OPEC+ announced this month plans to cut crude oil production by two million barrels of oil per day, a move that’s likely to support higher prices. And as consumers prepare to pay more, the S&P 500 is declining, while outstanding revolving consumer credit – think credit cards – has been expanding at historically high levels, suggesting that consumers are stretching to cover rising month-to-month expenses.

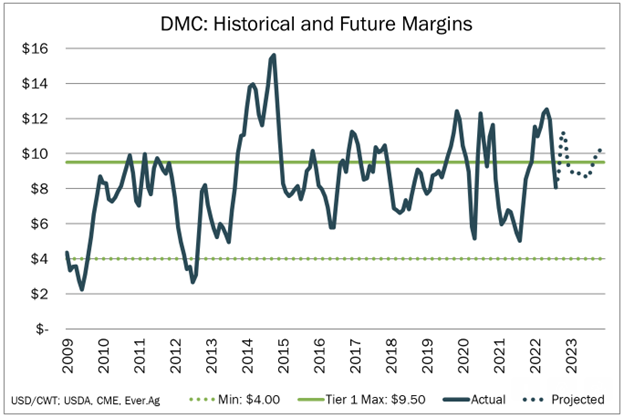

To that end, higher prices are placing global consumers in precarious positions. In a recent Gallup poll, 74% of lower income, 63% of middle income, and 40% of upper income consumers said price increases are creating financial hardships. To save money, consumers are driving less, buying fewer – and cheaper – groceries, eating out less frequently and only spending on essentials, Gallup reported. That could mean fewer bags of slices and shreds end up in shopping carts.  Amid uncertainty around dairy markets and the global economy, along with elevated farm-level costs, producers may want to devote some attention to managing their 2023 risk. One easy-to-use and inexpensive tool that deserves to find its way into your risk management portfolio is the Dairy Margin Coverage (DMC) program offered through your local Farm Service Agency (FSA). Coverage for the first 5 million pounds per year (416,666 pounds per month) costs $0.15 per hundredweight at the $9.50 coverage level. The $4 per hundredweight threshold comes free of charge, with buy-ups for $0.0050 offered at the $5 level before costs move significantly higher. It is important to note that the second tier is simply absolute catastrophic coverage, and there are likely better tools to protect profitable margins on those pounds. The 2023 deadline for DMC sign-up is Dec. 9, 2022. Amid uncertainty around dairy markets and the global economy, along with elevated farm-level costs, producers may want to devote some attention to managing their 2023 risk. One easy-to-use and inexpensive tool that deserves to find its way into your risk management portfolio is the Dairy Margin Coverage (DMC) program offered through your local Farm Service Agency (FSA). Coverage for the first 5 million pounds per year (416,666 pounds per month) costs $0.15 per hundredweight at the $9.50 coverage level. The $4 per hundredweight threshold comes free of charge, with buy-ups for $0.0050 offered at the $5 level before costs move significantly higher. It is important to note that the second tier is simply absolute catastrophic coverage, and there are likely better tools to protect profitable margins on those pounds. The 2023 deadline for DMC sign-up is Dec. 9, 2022.

Other tools to utilize beyond DMC include LGM-Dairy and Dairy Revenue Protection (DRP), both offered through Federal Crop Insurance and any licensed agency/agent. Futures/options on futures contracts provided on the Chicago Mercantile Exchange (CME) via brokerage firms and forward marketing programs are another path to reduce risk. The risk of loss trading commodity futures and options can be substantial. Investors should carefully consider the inherent risks in light of their financial condition. The information contained herein has been obtained from sources to be reliable, however, no independent verification has been made. The information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended to be a solicitation. Past performance is not indicative of future results.

Matt Tranel is a registered Associated Person with ever.ag, a registered Introducing Broker. Matt Tranel is also a licensed insurance agent with ever.ag Insurance Services, a licensed insurance agency in the following states: CO, FL, ID, IL, IN, IA, MN, NY, ND, PA, SD, TX, VA, WI. This agency is an equal opportunity employer.

|